Archive

A Worthy Cause

Our friend and colleague (and sometime competitor!) Jon Walters of Accuspace Measuring is training for an Ironman competition in Penticton. As part of his effort he is fundraising for Kiva. Here’s the details he sent us:

- you donate to the region and person of your choice: you can see the activity that is being supported

- loans can be very small

- your loan is tracked

- you are repaid: 97% repayment history

- administration fees are not included in loans; they are by donation

So I am dedicating this year’s effort to raising loans for Kiva and, to that end, I have started “JW’s 2009 Ironman Quest” loan community at this link:

Rather than just give money you’ll never see again, for as little as $25.00 you can extend a loan, not charity, to the entrepreneur of your choice in the county of your choice. Again, because the local people have a say in who gets the money and see to repayment, the repayment regime has been excellent.

Please take a close look at Kiva. It’s a great site that enables the concept of ‘micro-finance’ – a concept in foreign aid that empowers entrepreneurs rather than corrupt governments. To learn more, Google Dambisa Moyo.

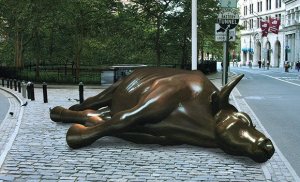

The End of a Wall Street Era

Here’s a really good Article by Michael Lewis on what lead to the Wall Street meltdown. It’s quite long, but very well written and demonstrates the points of view of several insiders. Great illustration too:

Thanks to Chris Gadula for pointing it out.

Canadian Banking System Rated Number 1

Recently we saw that Canada’s real estate industry was rated the most transparent in the world. Now our banking industry has earned similar praise. A World Economic Forum Survey now ranks Canada the top country for ‘Soundness of Banks’ out of 134 countries. Canadian banks were considered ‘generally healthy with sound balance sheets’. Canada also ranked number 6 for ‘Financial market sophistication’ and number 5 for ‘Strength of investor protection’

- I found out about this story on <a href="

http://deal-junkie.blogspot.com/2008/10/why-canada-has-stongest-banking-system.html “>’Deal Junkie’ - Read more about it at ‘Reuters’

- See the full report here (on the left select 2.3 Data tables and pick VIII: Financial market sophistication)

In these interesting times, you should invest your money in Canada. We may be a bit less interesting, but we’ll take good care of you!

The Price of an Invisible Hand

The ‘invisible hand’ of capitalism should naturally provide funding to projects and businesses that are likely to be profitable and create more value for society. Businesses that create ‘value’ produce real products and services that people are willing to pay for. These businesses do useful things and they do them at a cost that customers are willing to pay for.

But how much are we paying for this ‘invisible hand’?

Financial services comprise over 20% of GDP – not so invisible. It’s a very important sector – essential for everyone. We all need it like water and electricity, but do we have to pay 20% for it? Are we getting value for money?

I’ve found two great quotes:

The first one is from President Andrew Jackson in 1832 addressed to a bankers:

“Gentlemen, I have had men watching you for a long time, and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out.”

The second quote is a bit of dialogue from Tom Wolfe’s “Bonfire of the Vanities”. This is an apt explanation of finance addressed to a child – but it works for me!:

“Daddy doesn’t build roads or hospitals, and he doesn’t help build them, but he does handle the bonds for the people who raise the money.”

“Bonds?”

“Yes. Just imagine that a bond is a slice of cake, and you didn’t bake the cake, but every time you hand somebody a slice of the cake a tiny little bit comes off, like a little crumb, and you can keep that.”

Judy was smiling, and so was Campbell who seemed to realize that this was a joke, a kind of fairy tale based on what her daddy did.

“Little crumbs?” she said encouragingly.

“Yes,” said Judy. “Or you have to imagine little crumbs, but a lot of little crumbs. If you pass around enough slices of cake, then pretty soon you have enough crumbs to make a gigantic cake.”

If banks – and other financial entities – were more closely regulated or even partially nationalized, it would probably lead to a slight impairment to the efficient flow of capital. But would this not be worth it if we could avoid situations like the one we now find ourselves in? And after all, 20% of the economy is not an ‘invisible’ hand.

Why Was the CMBX Ever Interesting?

I became interested in the CMBX through my curiosity about the future of commercial real estate. Would the real estate crisis spread to commercial owners?

Why the CMBX? It’s a long story:

The first thing to do in assessing the expected future performance of an industry is to look at publically traded companies. They report their performance and projections. The collective reaction by the market is reflected in equity prices. It’s pretty easy to see what people think is going to happen in publically traded companies.

The problem is that a large percentage of commercial real estate is not held in public companies. There are listed REITs but there is also a vast amount owned by private companies and investors.

If you can’t see a market assessment of risk in equity prices, you can look at debt. The yield on bonds tells you something about risk. The higher the return, the more investors are being compensated for the potential risk of default.

The problem with debt is that this market has not been very liquid since the crisis began. There are very few real estate companies that have been issuing new debt during this period. At current low prices, these bonds do offer good cash flow returns.

If the debt market is stuck then perhaps the market for insurance default would be a good proxy for the health of the commercial real estate sector. After all, it turns out that the ABX index (a similar index for residential mortgage default CDSs) predicted the mortgage crisis several months in advance.

Now, the problem with the CMBX is that rather than simply tracking the price that bond holders pay for insurance, it has become an investment vehicle for hedge funds and others to speculate and bet against the issuers of the debt. This speculation is in turn hurting and distorting the actual debt market.

Finally, recent developments such as the bankruptcy of Lehman Brothers and the trouble at AIG mean that the issuers and dealers of the Credit Default Swaps are themselves in trouble. Are investors willing to buy derivatives when the ‘counter-party’ may suddenly disappear?

At this point I wonder if the CMBX index is related to conditions in the real estate sector at all. It might just be a speculator distorted, meaningless red line.

Credit Default Swaps and the CMBX

The Lehman Brothers bankruptcy was not expected. Many people thought that even if there was not a government bailout a take-over or sale might be a solution. If they were not able to spin off assets, then they might be acquired by another bank. As it turned out, there were no suitors and they are now in bankruptcy protection without any hope for recovery.

The lack of faith in the bank could be seen in the steadily declining share price in the months leading up to the failure. It could also be seen in the price of Credit Default Swaps (CDS) issued on Lehman debt. CDSs are like insurance policies that are taken out on a companies ability to pay debt obligations. As the risk of default increases, the price of the coverage increases. Here is a nice chart I found on <a href="http://bespokeinvest.typepad.com/bespoke/2008/09/lehman-default.html

“>Bespoke’s blog:

Lehman’s share price falls and the cost of insuring the company’s debt increase at the same rate.

Does this work for the CMBX index and real estate prices? To test this I have taken the spread for the CMBX index and overlaid the Dow Jones Composite REIT Index . We can see that the lines do appear to mirror each other. When equity goes up the price of CDSs goes down and vice versa.

In terms of relative valuation then, derivatives and actual equity prices are telling the same story. What is really interesting here is the spread. On a basket of AAA rated real estate backed bonds, the CMBX spread is around 200 basis points over LIBOR. This is a BIG spread. Lehman CDS were in this range in July…

Checking in on the CMBX index

What does the CMBX index now suggest about the future health of the commercial real estate industry? I’ve been interested in this index for quite some time – see my earlier posts:

CMBX is a derivative index that shows a market assessment of the risk for default for various classes of commercial mortgage backed bonds. In an efficient and rational market, this should be a good indicator of the future performance of the commercial real estate sector. Of course, these are not rational times.

This is what the index looks like today:

What does it mean? The index tells us what traders at hedge funds and investment banks have thought about the future of the market at various times in the past.

- At the beginning of the year, these bonds were considered to have almost no risk.

- In March, they were thought to be junk! Investors expected significant defaults. Perhaps commercial real estate would follow on the heals of the residential melt-down?

- Now, commercial mortgages carry a moderate risk premium.

Recent events are so far supporting the view that commercial real estate will suffer far less than the residential sector. Take for example the case of the Harry Macklowe, who bought several New York office buildings at the top of the market from Blackstone. He used $50 million of his own money and $7 billion of debt from Deutsche Bank. With that much leverage in a shaky economy, he soon ran into trouble. But he worked it out. Deutsche Bank took several of the buildings, but Macklowe retains a sizable real estate portfolio. The bank was then able to turn around and

sell the buildings very quickly. And the price they got was no more than 20% – 30% less than the value at the market peak.

The lesson is that unlike in the residential market, there are buyers for distressed property which offers significant protection for bond holders.

On the other hand, the general economic downturn in the U.S. will have an impact on the sector. Office Tenants are taking less space. Vacancies continue to rise in retail centres.

Even if there are far fewer structural problems in commercial real estate, risk in the sector is increasing due to the general economic downturn.

How to Read Financial Statements

This post is for people who don’t have a financial background, but still need to analyze corporate financial statements from time to time.

Like a lot of people, you don’t deal with finance most of the time. When you do need to review statements it can seem intimidating and confusing. Even after you figure them out you are left with the question: are they good? Or are they bad?

I Googled for a good simple explanation for how to read Financial Statements. The best result I got was this one from the SEC – but it’s still pretty complicated! The following is an attempt to describe them in basic terms so that you can get a quick understanding about what is going on in a company – and to give you a guide for how to ask intelligent questions.

Step 1 – Focus. Financial statements are often divided into four reports, but for an initial quick overview, we only need to look at two. Look for the Balance Sheet and the Income Statement (sometimes called Profit & Loss)

Step 2 -try to get a sense of the big picture before you drill down on details. Look for subtotals. If you need to compare companies to each other, you can only do this with the bigger groupings of accounts.

The main groupings and sub-totals of an income statement

Step 3 – look at profitability. Turn to the Income statement. The income covers a period of time. At the top is the total revenue that the company took in, at the bottom is what is left over as either a profit or a loss during that period of time. In between there are some very important sub-totals:

- The first expenses at the top apply to the expenses incurred to deliver the product or service. Often there is a sub-total for ‘Cost of Goods Sold’ and ‘Gross Profit’. These lines give you a good sense of how profitable the ‘business’ is.

- Underneath the ‘Gross Profit’ section are listed all the other expenses of the company. Here you can see what management is doing with expenses that are somewhat discretionary. Are they investing in the business? Do you think management is being wasteful in certain areas? Or are they under-investing in others?

- The net profit is the ‘bottom line’ – the amount of profit that is kept in the company over the period of time that the statement covers. A decent number here can either mean a good profitable business, or it could mean a business that is being milked for cash. Don’t look at this number before you understand the numbers above!

Typical main sections of a balance sheet statement

Step 4 – look at financial health. Turn to the Balance Sheet. This is a very confusing statement. It is stacked as two sets of accounts that add up to the same number. Unlike the Income Statement (which covers a period of time) it is a snapshot of the company as of a specific date.

- To understand this statement, you have to understand the concept of the Fundamental Accounting Equation: Asset = Liabilities + Shareholders Equity. The way to think of this is like this: what a company owns has to equal the way in which the company paid for what it owns. Assets are all the valuable things in a company: cash, receivables, inventory, furniture, land and property. The company acquired these assets either by taking a loan (liabilities) or by using the owners capital to pay for them. The capital can be the cash invested originally or it can be profits that have been left in the company. The Fundamental Accounting Equation says that the assets have to equal the debt and equity used to pay for the assets.

- How do you determine the financial health of the company? You need to look at the at the ‘short term’ debt – which means things that have to be paid soon such as payables and compare it to liquid or near liquid assets – which are cash and receivables. For these items liquid assets need to be a fair bit more than short term debt for the company to be comfortable.

- You should also look at the ratio of total debt and equity, but there is no absolute rule about the best relationship. Too much debt can be risky, but too much equity can be inefficient. The ideal balance can depend a lot on the industry and the type of business. If these seem out of wack, you should find out why.

Step 5 – Put the pieces together. Think about the net income on the Income Statement. Think about the liabilities on the balance sheet. Is the company earning enough to pay its obligations? And now think about the business itself. Will the income be steady or variable? If the revenue grows, will more capital and debt be required?

I hope these very basic steps will allow you to leverage Financial Statements into useful management tools that can help you better understand the workings and performance of a company.

In a future post, I will cover financial ratios which are very useful in comparing two or more companies in the same industry.

Canada: World’s Most Transparent Real Estate Market

Each year, Jones Lang LaSalle publishes a report on ‘real estate transparency’ that covers 82 countries. in their latest study, Canada was found to be the global leader!

Transparency is an economic concept that measures the amount of valid information that a buyer is able to access about a market. Transparency is an essential prerequisite for a free and efficient market.

The Jones Lang Lasalle Global Real Estate Transparency Index

looked at five key attributes of real estate transparency – performance measurement, market fundamentals, listed vehicles, legal and regulatory environment, as well as the transaction process.

For investors a high degree of transparency means that there is less risk. Laws are consistently applied and interpreted. Professionals have high ethical standards and accurate comparable market information is available.

For sellers of real estate there is also good news because a more efficient and transparent market will attract investment. The inflow of capital drives up prices. There is value in quality.

Congratulations to Canada’s commercial real estate professionals – world leaders in their field!

CMBX Predictions

Readers of this blog know I have an ongoing fascination with the CMBX index. What is it exactly? Why was it so high? And why has it come down again? What exactly does it tell us about the future of commercial real estate?

Here are links to my earlier posts:

- <a href="http://mikaelblog.spacedatabase.com/2008/03/markit-cmbx.html

“>Markit CMBX - <a href="http://mikaelblog.spacedatabase.com/2008/03/how-vulnerable-is-commercial-real.html

“>How Vulnerable is Commercial Real Estate? - What is CMBX exactly?

- CMBX Index

Well, here’s an updated picture of what it looks like today:

Apparently the CMBX index – the oracle that it is – no longer believes that there is a high risk for defaults in commercial real estate in the coming year. Remember that when the CMBX goes down, it indicates a lower ‘spread’ and therefore the prediction of a lower risk for default. This trend is happening just as real economic data is emerging that contradicts this sentiment: take a look at this post on Mish’s Global Economic Trends. Here are some highlights:

Vacancies in commercial real estate is increasing rapidly -it is expected to peak at 18% in 2008. Architectural billings in the US are down almost 78% over one year. look at the right-hand side of this chart :

Shopping centre vacancies are increasing rapidly – already at 28%:

And yet the CMBX index seems to suggest that the likelihood of defaults in commercial real estates has now gone down? Is this realistic? Or is this index too heavily influenced by short selling and speculation to be meaningful?

I found an interesting opinion on this on another blog. Myles Lichtenberg writes on

Maryland Commercial Title’s corporate blog about this. He quotes a report by Moody’s:

“If sellers were forced to sell, as can occur when banks foreclose on loans and subsequently sell off the collateral property, a more dramatic drop in prices would likely result.

However, when sellers are not compelled to sell, prices do not or can not adjust. In fact, prices can hover at some level in nominal terms for an extended period before responding to a changed market environment.”

The insight here is that even though the performance of commercial real estate might decline on a cash-flow basis, this will not mean that prices will fall. Large financial and institutional investors will choose to weather the storm. the number of transactions is likely to drop off, but prices are likely to remain much more stable than in residential sector. Asset price stability and the presence of well capitalized buyers will protect even the over-leveraged in the commercial real estate market. If the market value of the assets remain and as long as there are a few buyers, an cash strapped owner can get out by selling. The value of the asset as collateral will also help in any ‘work-out’ with lenders.

So have investors realized this difference? And has this insight been reflected in the CMBX index? Or am I reaching here? -just to maintain my faith in the value of a derivative index?

Factoid: Markit, the creators of the CMBX index is a spin-off from the TD bank – a Canadian connection!